Projects

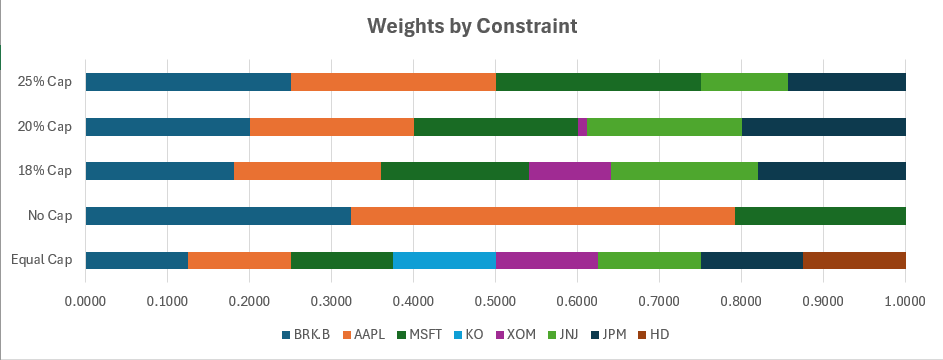

Sharpe Ratio Optimizer

Ultilizes Excel and takes 8 example stocks and their historical price data to calculate the optimal portfolio allocation that maximizes the Sharpe Ratio. Creates different allocations based on stock caps and compares the resulting portfolios' performance using various metrics and visualizations.

Download Project

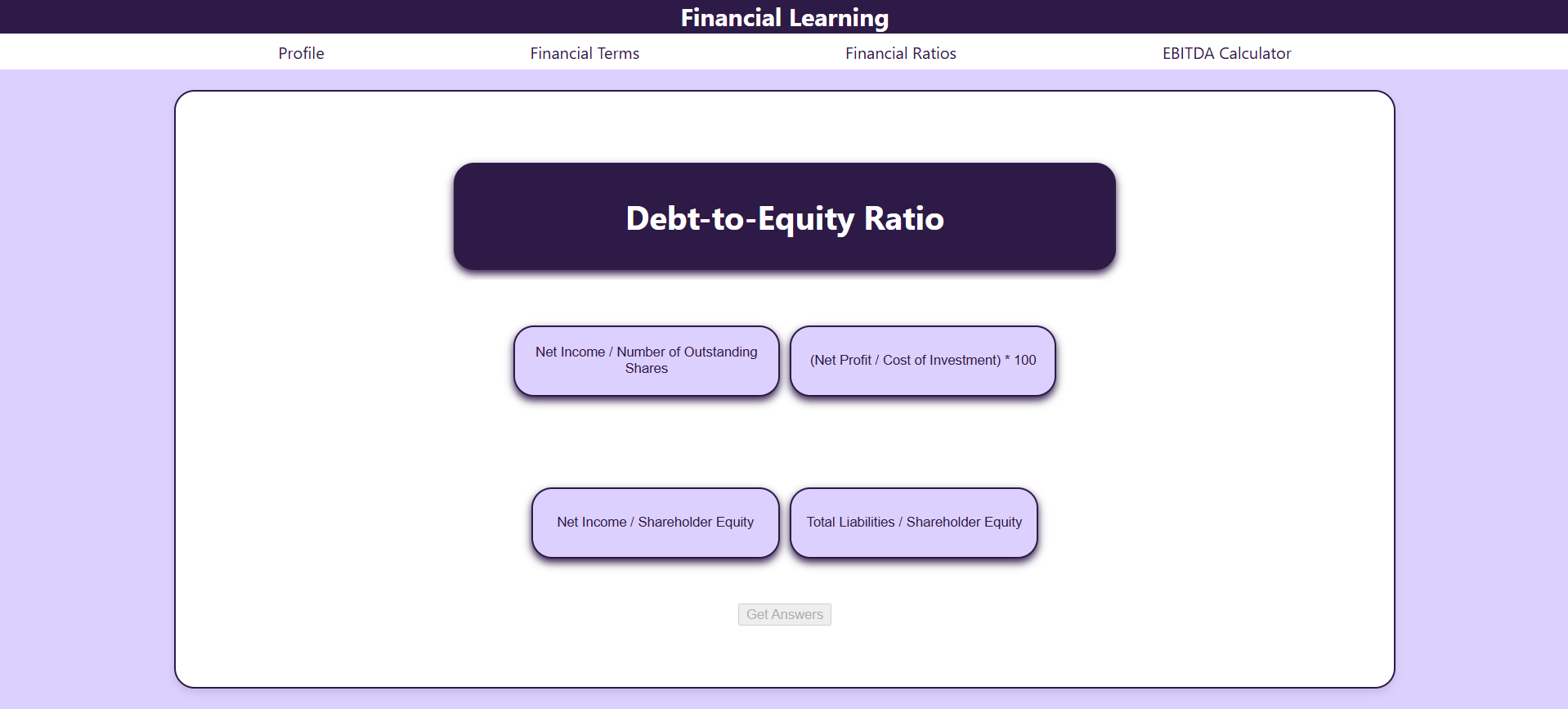

Financial Learning

A web application that allows users to learn about financial concepts through interactive quizzes and resources. The app is built using React and Node.js, with badges and statistics to track user progress. Made at UGAHacksX hackathon. Project concept provided as a challenge by the UGA FinTech program from Truist.

View Project

NHL Weather API

A Java executable that uses the OpenWeather API to get the current weather for a the hometown of a user-selected NHL player. The program uses the NHL API to get information about the player, and then pipes the hometown of the player to the OpenWeather API to get the real-time weather for that location.

View Project